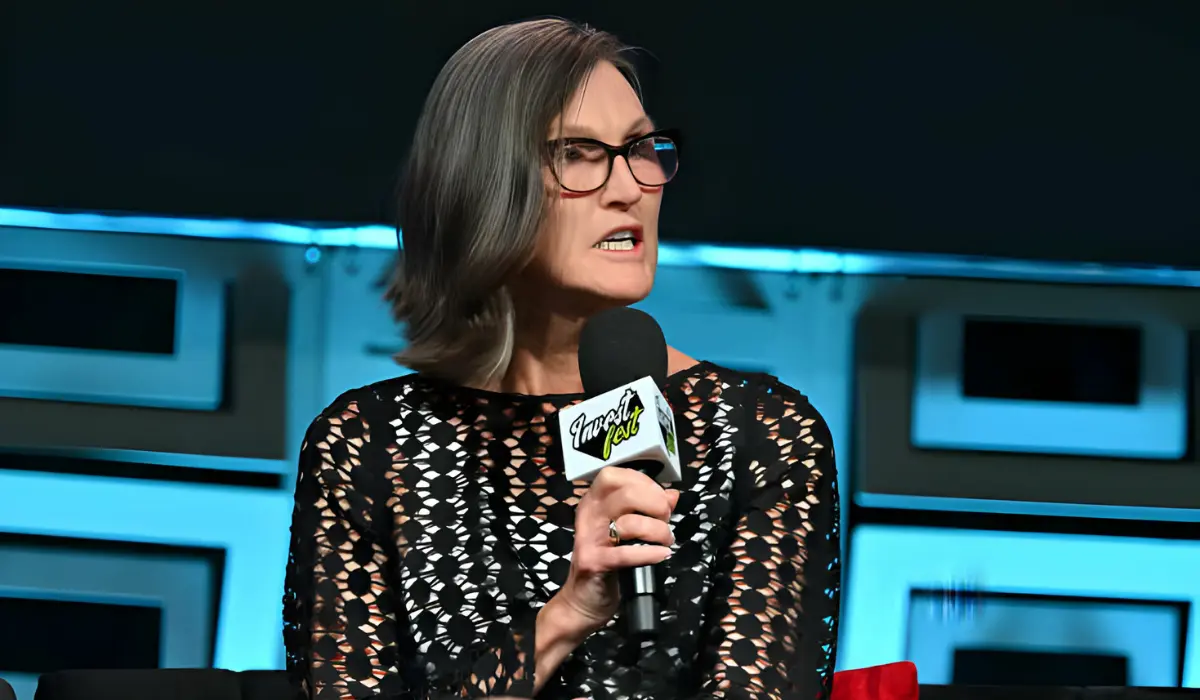

Cathie Wood, the CEO of the American asset management company, ARK Invest, referred to Bitcoin as a ‘Financial Super Highway’. Wood has also become successful in her spot in Bitcoin ETF as it has become one of the top ETFs issued in 2024.

Wood was speaking at the Friday Bitcoin Investor Day Conference in New York and her comments on Bitcoin were made on a fireside chat at the conference. She pointed out that nations were adopting Bitcoin as their currency is facing a depreciation. Wood mentioned Nigeria and other countries.

She said that global situations hint that not all is well in the world. Wood views Bitcoin as a risk-off asset and a risk-on asset. She thinks that BTC has miles to go and highlighted that her previous call of a 1.5 million US dollar price target has been maintained.

Why spot BTC ETF?

Ark Investment, her company, has recently issued a spot bitcoin ETF (exchange-traded fund) namely ARKB, and has made it to the top-of-the-spot BTC ETFs that were approved by the SEC in January 2024. A spot BTC ETF holds actual bitcoin, a certain equivalent amount of the underlying asset which is represented by the ETF. It is different from BTC Future ETFs as they do not hold the actual Bitcoin.

An investor will find the spot bitcoin ETF to be of great help as it helps them get direct exposure to the spot price of the bitcoin. At the same time, they do not have to purchase the BTC or store the BTC themselves.

Cathie Wood said she was “shocked” when she saw the hike in the interest rates of the U.S. Federal Reserve. This and the currency depreciations that many countries already face and more nations are to face soon signals that cryptos will have increased user cases in the coming days.

She focuses on the worldwide emerging markets and the global macro environments with her spot bitcoin exchange-traded fund. The current economic dilemmas persisting in the world will give Bitcoin the notion of a financial super highway as more people and governments will soon start adopting BTC on a larger scale.

Wood has not provided a particular price target but she thinks all these will increase the price of BTC. When more institutions enter the crypto space BTC’s price can soar up to 3.5 million US dollars.

Previously when spot BTC ETFs won the SEC approval

Earlier in Jan 2024 Cathie Wood had said that she saw a bullish growth in the market value of Bitcoin and that the crypto has the potential to reach 1.5 million USD which has become true now. She was talking about The U.S. Securities and Exchange Commission’s approval for spot Bitcoin ETFs.

The SEC’s approval of spot bitcoin ETFs has been trying to get issued for almost a decade. Wood’s ARK was one of the key investors who got their spot BTC ETFs approved. The SEC had approved a total of 11 spot BItin ETFs. This approval gave form to some groundbreaking products to get launched in the crypto market.

More about ARKB….

ARKB can be seen as a tool for diversification. It helps you diversify your portfolio by letting you add an asset having a low correlation to the traditional assets present. What it opens up is regulated access to one of the top digital assets. You can do this even if you are not a crypto veteran and do not have in-depth knowledge of safely trading or storing it.

Bitcoin was the first ever decentralized cryptocurrency and it is the largest in the market. Among all the cryptos present, Bitcoin has the largest growth potential and currently serves as the biggest digital asset with a market cap above 850 billion US dollars.

What ARKB does is help you hold the actual Bitcoin and serve as a vehicle for long-term strategic holding. The BTC holdings are kept in cold storage by a legit institutional-grade custodian. This enables you to get direct exposure to this BTC which is well-regulated at the same time. Here cold storage can be defined as a practice that will keep the BTC in offline environments and secure and it also safeguards them from any online hacking or threat thefts.